Next-Gen Africa: The New Frontier for Global Business Expansion?

Africa, a vast and intricuously complex continent comprising 54 sovereign countries, defies simple characterization.

Attempting to encapsulate its entire essence in a brief article is a formidable task, yet we endeavor to provide a concise overview for those not intimately acquainted with its rich tapestry.

When it comes to doing business in Africa, perspectives vary widely, ranging from harnessing its abundant natural resources and tapping into its burgeoning labor market to exploring investment and partnership opportunities.

While the continent is also a vibrant tourist destination, this aspect will not be our focus here. Instead, we aim to give you a quick update on the economic figures and shed light on the Africa labor market.

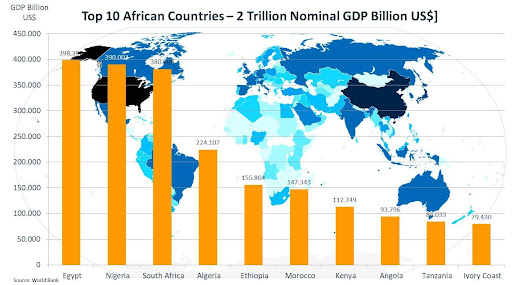

Overall Market Size

- Africa’s combined GDP was estimated to be over $2.6 trillion USD in 2021, according to data from the World Bank and other international financial institutions. This makes it one of the smaller continental economies globally, reflecting both its development challenges and its vast potential for growth.

Ranking of Countries by GDP

The ranking of African countries by GDP demonstrates the economic disparities within the continent, with the largest economies driving regional growth. The rankings can fluctuate based on various factors, including commodity prices, political stability, and global economic conditions. Based on nominal GDP, the largest economies in Africa typically include:

- Nigeria: With its significant oil reserves, Nigeria often ranks as Africa’s largest economy, with a diverse economy that also includes finance, telecommunications, and agriculture.

- South Africa: Known for its mining industry, manufacturing, and services sector, South Africa is a leading economy in the continent, though it faces challenges such as high unemployment and income inequality.

- Egypt: With a strategic location and a diversified economy including agriculture, manufacturing, and services, Egypt is a significant player in Africa’s economy.

- Algeria: Primarily driven by oil and gas exports, Algeria’s economy benefits from its large hydrocarbon reserves.

- Morocco: With a growing manufacturing sector and a robust tourism industry, Morocco has been expanding its economic influence in Africa.

- Kenya, Ethiopia, Ghana, Angola, and Tanzania are also notable for their economic sizes and roles in regional economies, each with unique strengths such as agriculture, manufacturing, and services.

Economic Growth and Prospects

- Economic growth across Africa varies significantly by country, with some nations experiencing rapid growth rates driven by investment in infrastructure, natural resources, and growing consumer markets. Others face challenges that hamper growth, including political instability and economic policies.

- The African Continental Free Trade Area (AfCFTA) aims to significantly enhance economic integration and growth by creating a single market for goods and services, potentially making Africa the largest free trade area in the world by the number of participating countries.

- Digital transformation is also seen as a key driver of future growth, with increasing internet penetration, mobile money, and innovation in various sectors.

African Labor Market

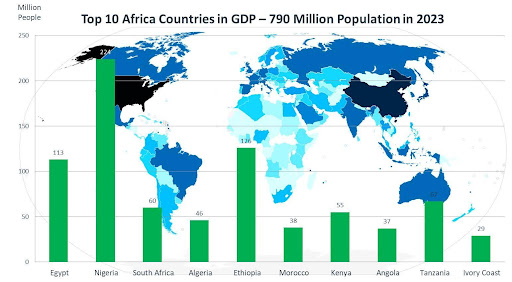

The African labor market is diverse and dynamic, reflecting the continent’s vast economic, social, and geographical diversity. It encompasses 54 countries, each with its own unique labor market characteristics shaped by a variety of factors such as economic development, natural resources, education levels, and demographic trends. Here are some key points to understand about the African labor market:

- Youthful Population: Africa has the youngest population in the world, with a median age of around 19 years. This demographic dividend presents both opportunities and challenges. On one hand, it offers a potential boost to the continent’s labor force and economic productivity. On the other hand, it poses significant challenges in terms of creating enough jobs to meet the demand of a rapidly growing workforce.

- Informal Sector Dominance: A large portion of Africa’s labor market is informal. The informal sector includes unregulated and untaxed businesses and employment that are not protected by legal or regulatory frameworks. While it provides livelihoods for the majority of Africa’s workforce, it also means that many workers are without formal job security, social protection, or benefits.

- Agriculture as a Major Employer: In many African countries, agriculture remains the backbone of the economy and the largest employer, particularly in rural areas. However, agricultural productivity is often low, and there is a significant movement towards urbanization and non-agricultural sectors such as services and manufacturing.

- Rapid Urbanization and Industrialization: Urbanization is accelerating across Africa, leading to the growth of cities and the gradual shift from agriculture-based economies to more diversified, urban economies. Industrialization is seen as a key driver for economic growth and job creation, although progress varies significantly across countries.

- Skills Mismatch and Education: There’s often a mismatch between the skills of the workforce and the needs of employers. While there’s a growing number of tertiary education graduates, many African countries struggle with the quality of education and vocational training, leading to high levels of youth unemployment and underemployment even among educated individuals.

- Regional Variability: The labor market conditions in Africa vary widely between regions and countries. North Africa, for instance, has different labor market dynamics compared to Sub-Saharan Africa, influenced by factors such as oil and gas resources, political stability, and ties to the Mediterranean and Middle Eastern economies.

- Challenges and Opportunities: African labor markets face several challenges, including high rates of unemployment and underemployment, labor market informality, and the need for job creation in line with population growth. However, there are also significant opportunities, such as the potential for technological leapfrogging, the development of new sectors like digital economies, renewable energy, and the continental free trade area aiming to boost intra-Africa trade.

- Impact of COVID-19: The COVID-19 pandemic has had a significant impact on African economies and labor markets, exacerbating existing vulnerabilities and inequalities. Recovery efforts are ongoing and include measures to support the informal sector, stimulate job creation, and leverage digital technologies for economic growth.

Understanding the African labor market requires a nuanced approach that considers both the challenges and the vast potential for growth and development. Policymakers, international organizations, and private sector stakeholders are focused on creating sustainable economic policies and investments that can harness the demographic dividend, promote formal employment, and foster inclusive economic growth.

Education System

When it comes to education systems and talent, several African countries stand out for their efforts in education and talent development:

- Mauritius: Often cited for its high-quality education system in Africa, Mauritius has invested significantly in education, which is compulsory up to the age of 16. The country focuses on creating a skilled workforce to support its economy.

- South Africa: With several high-ranking universities and research institutions, South Africa has a strong higher education system. However, the country faces challenges in basic education in terms of access and quality for all.

- Kenya: Known for its innovation in technology and mobile payments, Kenya has a vibrant tech scene and a growing number of tech startups. The country’s education system has been evolving to support technology and innovation.

- Rwanda: Rwanda has made significant strides in education and ICT development, positioning itself as a hub for technology and innovation in East Africa. The government’s investment in education and digital infrastructure has been key to this success.

- Egypt: With a long history of education and a large pool of graduates, Egypt has a strong focus on higher education and research, particularly in engineering and medicine.

These countries have made notable progress in developing their education systems and nurturing talent, particularly in areas that align with their economic growth strategies and development goals. However, across Africa, there remains a pressing need for continued investment in education, skills training, and job creation to fully harness the potential of the continent’s youthful population.

Cost of Talent:

Companies looking to hire talent from these African countries can often find high-quality candidates at more competitive rates compared to the Western world, but the total value proposition goes beyond cost savings to include talent availability, innovation potential, and the opportunity to tap into growing markets.

The cost of talent and average income levels vary significantly between African countries and compared to the Western world, reflecting differences in living costs, economic development, and the supply and demand for skilled labor. Here are some general points on income levels and the cost of talent:

- Lower Average Incomes in Africa: Average incomes in many African countries are significantly lower than those in the Western world. This disparity is due to various factors, including economic development levels, productivity rates, and the prevalence of informal employment.

- Cost of Talent: The cost of talent in Africa can be lower compared to Western countries, especially for roles that don’t require high levels of specialization. However, for highly skilled professions, particularly in areas with a global shortage (e.g., IT, engineering, certain healthcare specialties), the cost of talent can be competitive as these professionals may have opportunities that pay globally competitive rates.

- Income Data by Country:

- Mauritius: As a higher-income African country, Mauritius has a higher average income level compared to many other African nations. The World Bank classified Mauritius as a high-income country as of my last update, reflecting its economic development.

- South Africa: South Africa has significant income disparity, with high average incomes in skilled professions but also extensive poverty. According to the World Bank, South Africa is an upper-middle-income country.

- Kenya, Rwanda, Egypt: These countries are classified by the World Bank as lower-middle-income countries. Average incomes here are lower than in high-income African countries and much lower compared to Western standards. However, in sectors like IT and finance, skilled professionals can earn salaries closer to global benchmarks.

- Labor Market Dynamics: The supply and demand dynamics in the labor market significantly influence talent costs. In many African countries, there is a high supply of labor, including a growing number of graduates each year, which can keep wages more competitive. In contrast, Western countries may experience talent shortages in specific sectors, driving up costs.

- Sector-Specific Demand: For highly specialized skills, particularly in sectors like technology, finance, and engineering, the cost differentiation might be less pronounced due to global demand for such skills. For example, a highly skilled software developer in Kenya or Egypt might command a salary closer to global market rates, although still generally lower than in places like the United States or Western Europe.

- Remote and Global Work Trends: The rise of remote work and the globalization of talent pools have started to influence salary dynamics. Talented professionals in Africa with skills in high demand globally may command higher rates than the local average, especially if they work for international clients or companies.

Despite these general trends, it’s important to note that salary and talent costs are not the only factors companies consider when hiring internationally. Other considerations include the quality of education, language skills, work culture compatibility, and the legal and regulatory environment for employment and business operations.

Companies looking to hire talent from these African countries can often find high-quality candidates at more competitive rates compared to the Western world, but the total value proposition goes beyond cost savings to include talent availability, innovation potential, and the opportunity to tap into growing markets.

Let’s compare the Gross National Income (GNI) per capita in Purchasing Power Parity (PPP) dollars for the USA, UK, Germany, France, and Singapore with the African countries mentioned, using the most recent data available up to my last update in April 2023. This will provide a clearer picture of the income disparities between these regions:

Here’s a table comparing the GNI per capita (in PPP dollars for 2021) between the five African countries and the five Western and high-income countries mentioned:

Country | GNI per Capita (PPP $) |

|---|---|

Mauritius | 22,030 |

South Africa | 11,440 |

Kenya | 4,150 |

Rwanda | 2,250 |

Egypt | 12,070 |

USA | 69,287 |

UK | 46,827 |

Germany | 55,083 |

France | 49,941 |

Singapore | 98,014 |

This table illustrates the significant differences in income levels, highlighting the economic disparities between these African countries and the more developed economies.

Sub-Saharan Africa (SSA) is a region of immense diversity and potential, spanning a spectrum from low to high-income countries, including fragile states and those rich in natural resources. Despite facing development challenges such as economic slowdown, with growth projected at 2.5% in 2023, conflict, and climate shocks, SSA presents significant opportunities for companies looking to tap into its labor market. With the world’s largest free trade area and a market of 1.2 billion people, the continent is poised for a unique development trajectory, leveraging its human and natural resources.

The region grapples with high debt distress risks, with efforts underway in countries like Chad, Zambia, and Ghana to restructure debt and rebuild fiscal stability. Economic growth varies across SSA, impacted by energy and transportation challenges in South Africa and Nigeria’s oil sector issues, alongside political instability affecting regions like the Economic and Monetary Community of Central Africa and the Sahel.

Nonetheless, SSA’s natural resources offer vast economic potential, especially in the transition to a low-carbon economy. Moreover, with the fastest-growing working-age population globally, estimated to increase by 740 million by 2050, and up to 12 million youth entering the labor market annually, the region is a burgeoning hub for talent. However, with only 3 million new formal wage jobs created each year, there’s a pressing need for investment in human capital, economic diversification, and policies promoting inclusive and jobs-friendly growth. This demographic trend underscores the necessity for businesses to engage with SSA’s labor market, leveraging the available talent pool to drive economic and social development while addressing the employment gap.

Go To’s: CEOs and HR Officers should assess their company’s expansion strategies and talent acquisition plans, considering how Africa’s young, dynamic workforce could fit into their growth objectives. Initiating market research, exploring partnerships, and investing in skill development programs in Africa should be immediate next steps as well as carefully looking into the many other market opportunities the continent could offer.