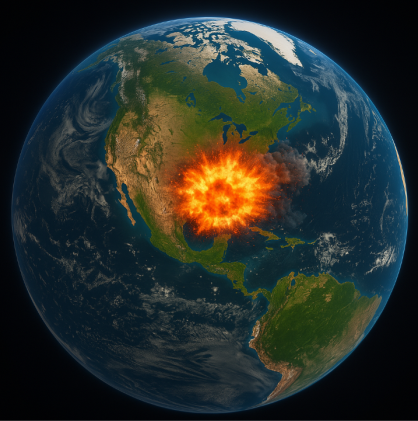

“D-Day April 2nd”: The Shockwave That Rocked Globalization

How Trump’s Tariffs Triggered Global Realignment—and What Comes Next

On April 2, 2025—dubbed “D-Day”—President Trump launched sweeping tariffs, shaking the foundation of global trade. With a universal 10% import tariff and targeted levies on China and the EU, the U.S. triggered retaliation from major economies, including swift countermeasures from China. Financial markets tumbled, inflation forecasts rose, and global supply chains reeled. Long-term trust in the U.S. as a reliable trade partner has eroded, prompting companies and consumers worldwide to seek alternatives.

Nations are accelerating free trade agreements—like RCEP, CPTPP, and AfCFTA—excluding the U.S. and forming a new, decentralized model of globalization. While the U.S. still accounts for 25% of global GDP, it represents just 4% of the population and up to 15% of global pollution—further incentivizing a pivot away. The world is not decoupling from globalization; it’s decoupling from the U.S. The future belongs to agile, regional, and resilient trade—fueled by trust, not tariffs.

- Welcome to the Disruption Age

On April 2, 2025, the world economy didn’t just wobble—it buckled. With the stroke of a pen and a blaring press conference, President Donald Trump declared “Liberation Day”, launching sweeping tariffs:

- A universal 10% tariff on all imports

- A 34% tariff on Chinese goods

- A 20% tariff on EU products

- Threats of more to come for any nation with a trade surplus with the U.S.

Markets panicked. Allies scrambled. Rivals retaliated. And the gears of globalization ground against a wall that hadn’t been there the day before.

- The U.S. in Global Context: Big GDP, Small Footprint

Let’s get the numbers straight to understand the stakes.

Metric | USA Share of Global Total |

Population | ~4.2% |

Global GDP | ~24–25% |

Global Exports | ~8–9% |

Global Imports | ~13–14% |

Energy Consumption | ~16% |

Raw Material Use | ~15% |

Greenhouse Gas Emissions | ~13–15% |

Plastic Waste | ~12% |

Key Insight:

The U.S. drives a quarter of the world’s economy—but only hosts 4% of its people. It’s resource-hungry, waste-heavy, and economically influential—but not essential to globalization’s future.

III. Global Fallout: Market Collapse and Economic Shock

Immediate Effects Post-April 2nd:

- $4.5 trillion in global market value wiped out in 72 hours

- U.S. consumer prices forecast to rise 2.3%

- Projected GDP slowdown of 1.5 to 2 percentage points

- Supply chains jolted into emergency re-routing

Investors fled. CEOs held emergency board calls. And the world began recalibrating its future—without waiting for Washington.

- China Retaliates: Game On

China wasted no time.

Within 48 hours, Beijing:

- Imposed matching tariffs of up to 30% on U.S. tech, agriculture, and industrial imports

- Suspended all rare earth mineral exports to U.S. defense manufacturers

- Activated currency measures to cushion export losses

- Re-engaged aggressively with Asia, Africa, and Latin America in new bilateral and regional trade deals

This isn’t just a counter-punch—it’s a long game.

- The Counter-Move: Global Trade Blocs Without the U.S.

While the U.S. builds walls, the rest of the world builds bridges. Here’s a quick tour of free trade agreements in motion—without America at the table:

- RCEP (Regional Comprehensive Economic Partnership)

- Members: China, Japan, South Korea, Australia, New Zealand, ASEAN

- Status: In force

- Covers: 30% of global GDP and population

- Goal: Deepen intra-Asia trade. U.S. completely excluded.

- CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership)

- Members: Japan, Canada, Australia, Chile, Malaysia, Mexico, Peru, Singapore, Vietnam, New Zealand, UK

- Status: Operational—and expanding

- Notable: Originally the TPP before Trump exited. Reborn without the U.S.

- EU–Mercosur Deal

- Members: EU + Brazil, Argentina, Paraguay, Uruguay

- Status: Finalizing ratification

- Purpose: Create one of the largest cross-continental trade areas

- AfCFTA (African Continental Free Trade Area)

- Members: 54 African nations

- Status: Actively expanding trade and investment across the continent

- Momentum: Building its own internal supply chain network

- India–EU, India–UAE, and India–ASEAN Deals

- India’s Strategy: Create regional alternatives to China and bypass Western trade disruptions

Bottom Line:

75% of global GDP is now in free trade networks that don’t need the U.S.

While America isolates, others integrate.

- Globalization 2.0: Fragmented, Resilient, Regional

Globalization isn’t dying. It’s mutating. Fast.

Old Model (1990–2020):

- “Go big, go global”

- Centralized supply chains

- U.S.-centric financial systems

New Model (2025+):

- Regional resilience > global scale

- Multi-nodal trade networks

- China, India, EU, ASEAN as poles of influence

- “Global minus America” alliances

For business rebels, this is the new map.

VII. How Businesses Should Respond

This is no time for paralysis. It’s time to recode your global strategy.

Go-To Actions:

- Localize supply chains to avoid tariff traps

- Diversify geographically—don’t bet on one region

- Establish legal presence in trade-friendly hubs (Vietnam, Mexico, Netherlands, UAE)

- Automate where possible to reduce dependence on human labor in volatile markets

- Monitor trade policy daily—or get a bot to do it

- Align with regional trade goals (e.g., carbon neutrality in the EU, tech independence in Asia)

- Treat the U.S. as one of many markets—not the center of your strategy

VIII. The Bigger Picture: A Shifting World Order

April 2nd wasn’t just about tariffs. It was a loud declaration that economic nationalism is back—and it’s contagious.

But here’s what matters most:

- Global trade is still expanding, just without central coordination

- New powers (India, Brazil, ASEAN) are rising as manufacturing alternatives

- The U.S. may isolate itself from innovation pipelines, green tech flows, and digital standards unless it re-engages

- Rebel’s Final Take: Don’t Mourn the Old—Build the New

This moment feels seismic because it is.

But in every disruption lies opportunity:

- New supply chains

- New customer bases

- New alliances

- New geopolitical anchors

You don’t need to fear the collapse of old trade empires. You just need to pivot fast, act smart, and globalize on your own terms.

X: The Trust Collapse – How the World May Unplug from U.S. Dependence

When President Trump pulled the tariff trigger on April 2nd, it wasn’t just trade deals that were disrupted. It was trust.

Not just from foreign governments, but from businesses, investors, supply chain partners—and consumers. And that erosion might prove far more damaging than a temporary economic dip.

- Trust Is a Long-Term Currency—and the U.S. Just Spent It

For decades, the U.S. stood as a pillar of trade predictability. The world may not have always liked its terms, but it could count on a certain degree of stability, rule of law, and institutional memory. Those days are slipping fast.

Now the world sees a U.S. that:

- Rewrites its trade rules every election cycle

- Unilaterally imposes massive tariffs with little warning

- Is willing to weaponize its market power for domestic political points

In response, the global business community is quietly doing what investors always do when faced with uncertainty:

De-risk. De-leverage. Diversify.

- The Rise of “Tariff-Free Consumer Capitalism”

While governments retaliate with counter-tariffs, the real long-term shift may come from consumers.

Imagine a future where:

- European and Asian consumers are incentivized to buy locally within their trade blocs

- “American-made” becomes expensive, erratic, and politically toxic in some regions

- Brands that were once global giants become regionalized, avoiding U.S. inputs to dodge tariffs or reputational risk

This isn’t just theory—it’s already happening:

- EU consumers are shifting to intra-European e-commerce platforms post-tariff shock

- Asian electronics firms are redesigning products without U.S. tech components

- LATAM startups are actively marketing “U.S.-free” supply chains as a feature, not a bug

In a world where 95% of consumers live outside the United States, this matters.

- Strategic Consumer Behavior: Ethical + Economic = Exclusion

We’re entering an era where global consumers will actively choose to decouple from American products—not out of hate, but out of self-interest and price sensitivity.

It’s a new kind of consumer logic:

“If American goods are 30% more expensive, and may be banned or taxed again next year, why take the risk?”

Combine that with:

- Environmental concerns (U.S. emissions footprint is among the worst per capita)

- Digital regulation clashes (GDPR vs. Silicon Valley’s surveillance model)

- Rising nationalism in other countries

…and the consumer exit from U.S.-centric trade is already under way.

- Trust Is Hard to Rebuild—Especially in Supply Chains

In the supply chain world, trust is infrastructure.

When companies see the U.S. treat allies the same as rivals (e.g., Canada, EU, Japan hit with the same tariffs as China), the message is clear:

“If it happened to them, it could happen to us.”

Result?

- Fewer long-term contracts with U.S. suppliers

- More inventory hoarding and duplication outside U.S. borders

- Less dependency on U.S. logistics hubs, financing, or IP

- The New Loyalty: Predictability Over Power

In this new global order, power doesn’t win loyalty—predictability does.

Consumers and companies alike are turning toward:

- EU trade corridors, governed by treaties and climate-aligned standards

- ASEAN and African markets, growing rapidly without American strings

- Digital ecosystems run on local data policies and global open-source tools, not U.S.-controlled infrastructure

In short, the world is not waiting to trust the U.S. again. It’s building around it.

Stay bold, stay global—and never wait for permission to rewrite the rules.

—The IEC Rebel’s Digest Team

Go To’s: After rading this article you should

- Diversify supply chains across regions to avoid tariff exposure.

- Establish legal entities in trade-friendly zones like Vietnam(for non-US markets), India,Mexico, or the Netherlands.

- Monitor global policy shifts and integrate predictive risk tools.

- Build consumer trust through localized branding and non-U.S. sourcing.

- Align with emerging trade blocs (RCEP, CPTPP, AfCFTA).

- Automate where possible to reduce cost volatility.

- Treat the U.S. as one market—not the center of your strategy.

- Reduce reliance on U.S. tech, finance, and logistics infrastructure.

- Prioritize resilience, not just efficiency.

- Most importantly, move fast—agility is the new advantage in a fragmented, post-trust global economy.

- Audit your current global team’s compliance

Last but not Least: If you’re facing challenges and wondering how others are managing similar issues, why not join The Leadership Collective Community? It’s a peer group and webcast platform designed for leaders to exchange insights and experiences.

Introducing the IEC Knowledge Network Free Membership – Your Gateway to Seamless Access!

We are thrilled to present a new service that goes beyond the ordinary download experience. In addition to offering you the ability to download the things you love, we are delighted to introduce the IEC Knowledge Network Free Membership.

The Free Membership option grants you access to our library of articles and videos, without the need for tedious registrations for each piece of content.

The publication serves as a trusted resource to support executives in their pursuit of sustainable and successful global expansion. In addition the IEC Practitioners are available to discuss your specific challenge in more detail and to give you clear advise..

Take advantage of this valuable resource to accelerate your global expansion journey